A point of universal agreement during every election year is that we need a good economy. Voters are offered an assortment of propaganda about why each particular candidate’s agenda is best for the economy. Obviously the United States and the world have major problems with the economy. Europe and Japan are trying negative interest rates, an economic poultice that has never been tried before. And so far it is not working.

We need to first think about what it means to have a good economy, and then we can correctly evaluate how each candidate might get us where we want to be.

For Whom?

For working Americans

Those who work for a company or in their own business producing valuable goods and services for customers, a Good Economy is when working Americans have a full time job matched to their skills and abilities and they are receiving middle class wages. When everyone has middle class wages they purchase homes and lots of things for them, automobiles, travel and entertainment – things that make life enjoyable. All of these purchases generate economic activity that allows other Americans to earn middle class wages. This is the consumer economy and it makes up about 70% of all economic activity in the United States.

For professional investors

For the pros, a Good Economy is when things are set up to make the stock market go up. As the stock market goes up, stock investors get richer. Stocks go up for a lot of reasons, some financial and some emotional. Improving financial performance of publicly traded companies causes their stock price to rise. Reduction in interest rates increases the value of future cash flows which also tends to cause stock prices to rise. Emotional feelings also move the stock market; optimism about future economic conditions fuels stock price increases, whereas concerns about the future may trigger a sell-off.

For Corporations

A Good Economy is when things are set up to allow profits to increase. Profits can increase through higher prices, lower costs, or increased volume of business. Corporate profits also benefit from lower taxes.

For Billionaires

For individual billionaires, a Good Economy can mean several different conditions. Billionaires often have a large stake in a single enterprise, such as Bill Gate’s ownership of a large chunk of Microsoft, or Larry Ellison’s ownership of Oracle. Policies that help Microsoft or Oracle stock to go up are good for those particular billionaires. Billionaires are investors. Billionaires like policies that make stocks go up. The income tax bill for a billionaire can be staggeringly large, so it is not surprising billionaires may focus on policies that reduce taxes as being good for the economy.

However Steve Forbes and Warren Buffet both said that it doesn’t much matter who is in Washington because they will do all right no matter who is running the country. Or to put it another way, the smartest billionaires are rich because they know how to prosper in any environment.

____________________

These goals are often in conflict. Reduced costs for a corporation mean lower wages for American workers. Reduced taxes for the rich mean higher taxes for the not rich.

These different (and conflicting) definitions of a Good Economy are the reason that politicians use a lot of vague promises to get elected. A Republican candidate can stand in front of any group of voters and promise to enact policies to promote a Good Economy, allowing the voters to fill in their own definition of what he or she means.

Since the Great Recession America has experienced an unprecedented economic phenomenon. The Gross Domestic Product and corporate profits have recovered from 2009 levels, driving the stock market to new highs, but wages for working Americans have not risen. This is the fundamental problem with the economy today. The consumer economy that is supported by the purchases of ordinary Americans is anemic because Americans do not have as much money to spend, relative to the economy as a whole, as they had in previous eras. Fed action to lower short term interest rates to 0% had very little effect on the economy. Many economists with vision firmly planted in the rear view mirror predicted that the zero percent interest rates would spawn runaway inflation, but the dreaded inflation never materialized. Fed minutes are now littered with arguments to justify raising (normalizing) interest rates on the grounds that the members believe that the economy can probably tolerate a rate increase, rather than to to throttle an overheated economy that the hawks predicted would occur about five years ago.

The healthiest economic period in modern American history is the period from the end of World War II in 1945 until the early 1980’s. During that time, wages and the standard of living for ordinary working Americans consistently rose and fueled the American consumer economy which was the envy of the world. The biggest gold mine on the planet was the American consumers. If a company developed a product that American consumers wanted, the economic rewards were enormous.

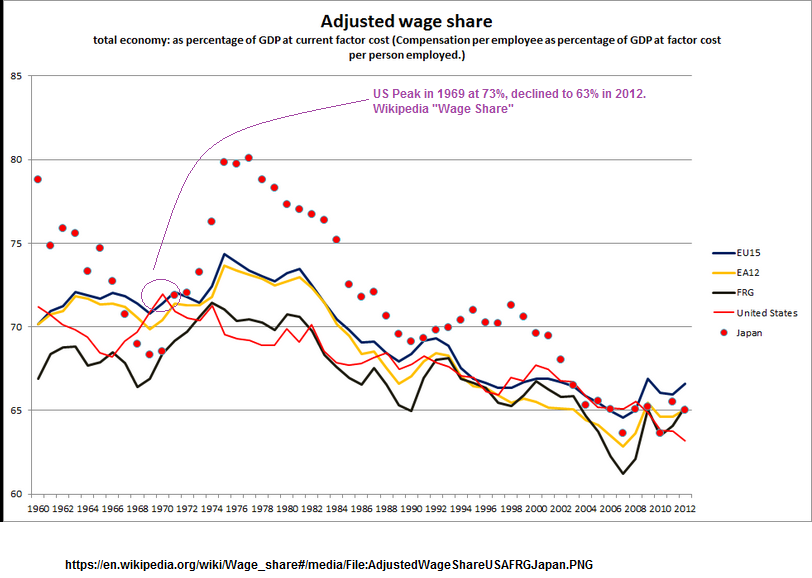

The prosperity of the 1945 – 1985 period was based on an economic measure called Wage Share. Wage Share is the proportion of Gross Domestic Product that is paid out in wages to American workers and other developed nations every year.

The graph above illustrates Wage Share as a percent of GDP for the United States and other nations for the period from 1960 to 2012. As indicated by the red line, Wage Share in the United States peaked at 73% in 1969, declined slightly to 72% in the early 1970s, and then declined continuously to less than 65% at the lowest point on the chart in 2012. Over the same period of time, corporate earnings, earnings of the richest people in the world, and the stock markets have all grown to new records highs.

The fact of the concentration of wealth in the hand of very few individuals has been documented in the last few years by many credible sources. A neutral summary of the situation is available in Wikipedia in the article Income Inequality in the United States. Citing data from several sources, the article reports that the proportion of the wealth produced in American that is paid to the top 1% has risen from about 10% in 1970 to almost 25% today.

There are several fundamental facts to keep in mind when discussing the economy.

First, the wealth of the nation is valuable goods and services that are produced by all economically active producers. Monetary amounts are used to measure the wealth, but the measurement only has meaning when it is conceived in terms of the desirable things that the money can buy. Every valuable good or service is produced by a person who is doing productive work. This is an economic fact that many would like to suppress. Because if you acknowledge this inescapable truth, then it follows that the people who do the work and produce the valuable goods and services have a legitimate claim to receive a fair share of the wealth they produce.

But there is another argument in favor of a more fair distribution of wealth between workers and the one-percenters that doesn’t rely on idealism and fair play; almost everyone’s good economy needs consumers with money to spend.

Suppose you imagine a future where technology has advanced and a handful of Silicon Valley geniuses have created a huge sophisticated computerized company that can create any product completely automatically without the need for labor. Pipelines bring in raw materials from near and far. Computers control 3D printers and automated fabrication machines that can make clothes, automobiles, food, medicine, even complete homes. Products are delivered by a fleet of computerized trucks that drive themselves and automatically load and unload the goods. Online animated characters interact with humans over the Internet to provide personal services like health care. Over twenty years the geniuses enhance and refine the automatons until they can produce almost everything that the nation needs. In this futureworld, the Silicon Valley titans end up owning virtually the entire GDP of the nation.

But there is a problem. The customers have no money.

Billionaire genius Elon Musk as expressed some interesting thoughts about the future effects of technology advances.